Share this

Inside Look: A Bi-Weekly Analysis of Loadsmart’s Data & Market Indices

by jpallmerine

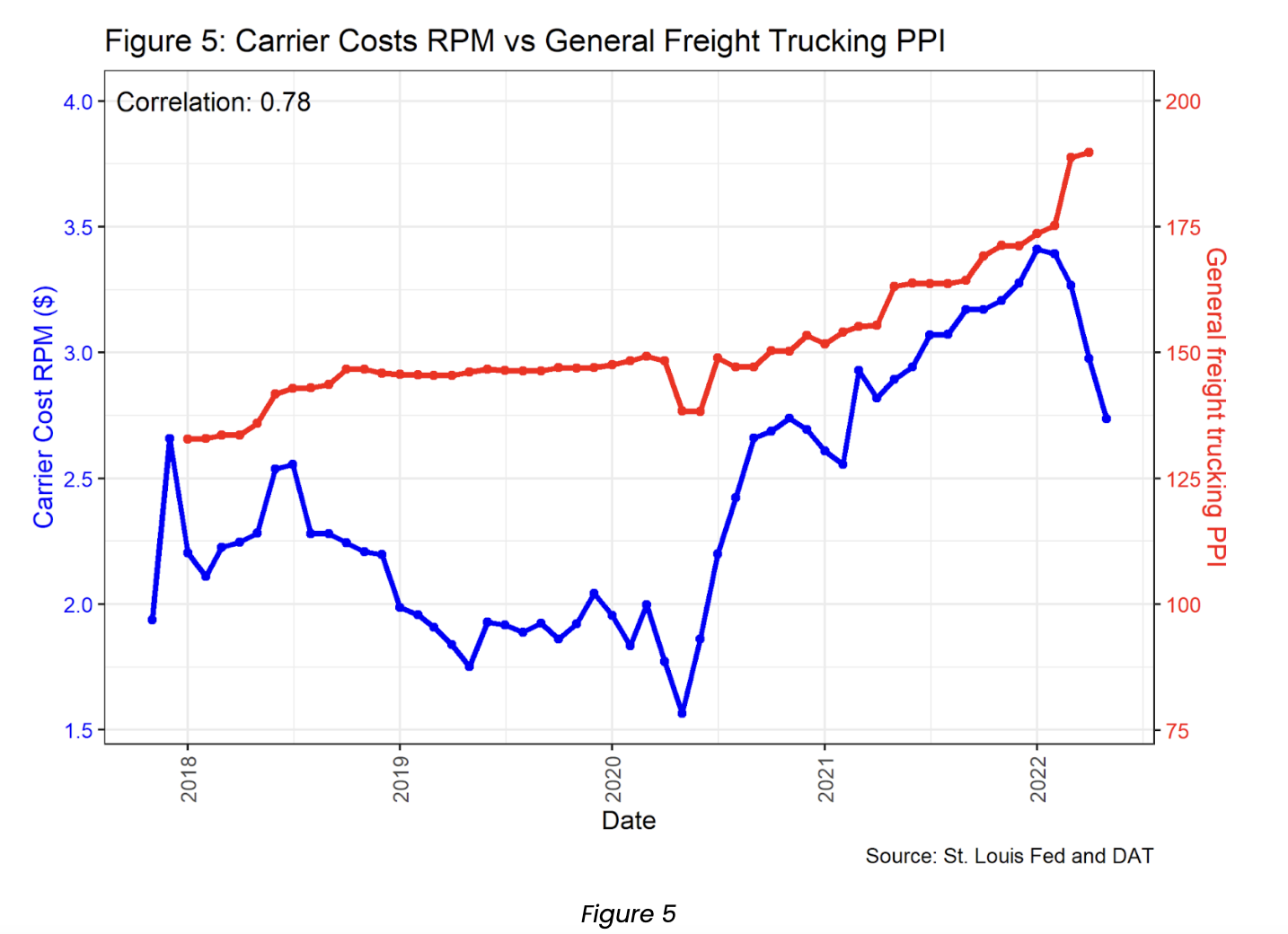

Despite a softening macro environment year to date, over the past two weeks Loadsmart is seeing rate stabilization and minor tightening in the full truckload market – capacity remains available and volumes have leveled out after their significant decline in March/April (as seen in Figure 1 below).

Full Truckload Spot Market Overview

- We’ve seen widespread price reductions in the Full Truckload Spot market since March, with volumes decreasing and a surplus of drivers in the market.

- Truckload Demand softening stemmed from overstocked inventories, consumer spending slowdown & a shift from durables to services, recent inflation, higher interest rates, climbing oil prices and global conflict.

Loadsmart’s Rate Index plummeted by -26% from March 1st to May 1st. Since May 1st, however, our rate index made its most significant recovery YTD’22

- As seen in Figure 1 above, in the first three weeks of May there has been a noticeable recovery in the price level (+5%), which was likely due to produce season impacts, a surge in demand from our top retail shippers, and Road Check-related tightening.

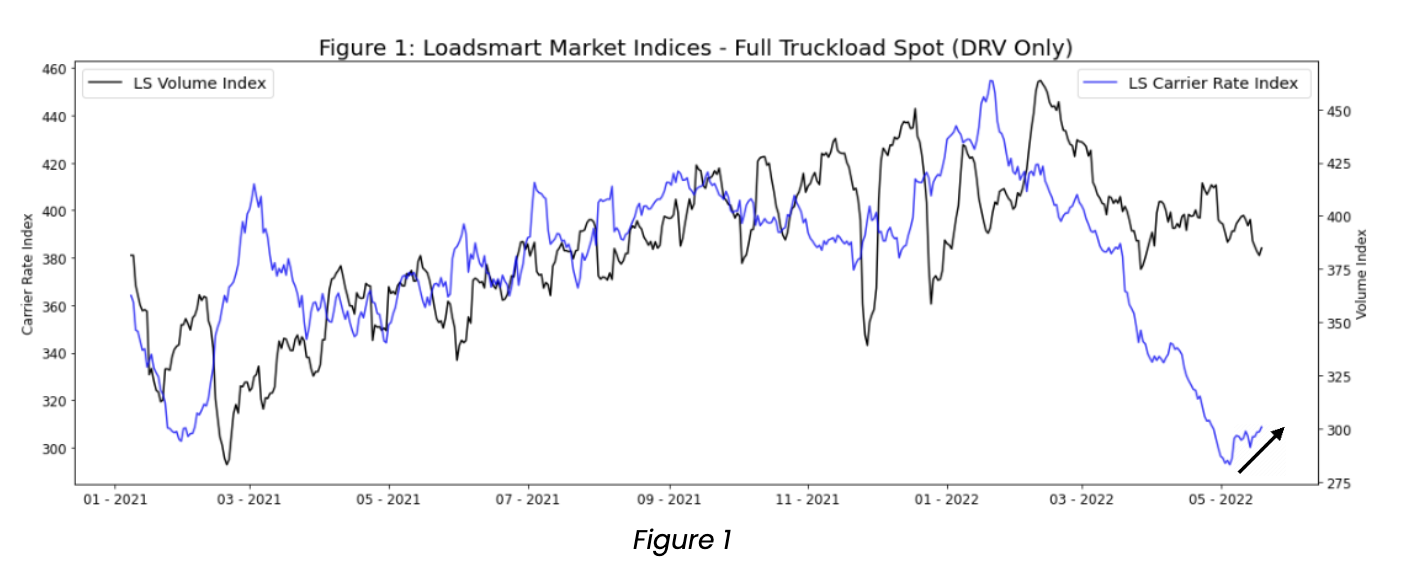

- As seen in Figure 2 below, Inventories to Sales Ratios spiked toward the end of 2021, leveled out for January ’22, and began increasing again more recently. With durable good consumption slowing down as indicated by the increasing index, shippers will inevitably need to move less freight. We expect this ratio to continue to increase over the coming months (due to inflation, consumption shift to services, economic slowdown, etc)

Loadsmart’s “Hot Take” for the Full Truckload Market over the next 2 weeks

We predict continued stabilization in the FTL Dry Van Spot market over the next two weeks – with Memorial Day and End of Month, we expect to see rates increase another ~2-3% before stabilizing

Notable Freight & Economic Relationships

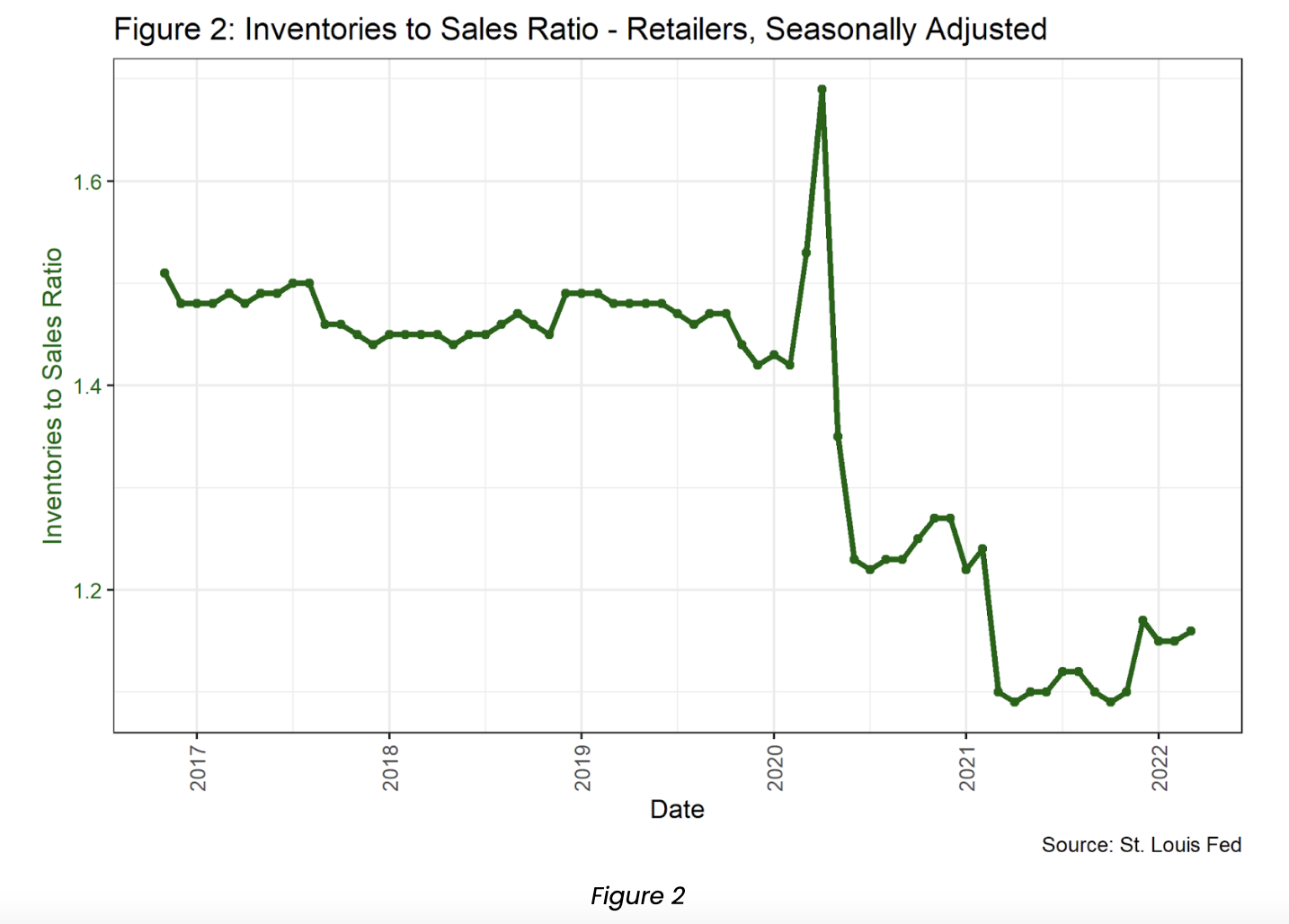

DRV rates vs. Retail Sales

- As shown in Figure 3 below, we’ve observed that dry van spot rates are largely associated with the online retail sales volumes.

- February data (most recent data available) shows e-shopping and mail orders are following the usual post-Christmas downward trend. Yet, YoY sales are nearly at the same level. The Commerce Department’s preview shows a 5% increase in non-store retail sales (e-shopping and mail orders are a subgroup of it) in April, suggesting that retail demand could be increasing more than expected.

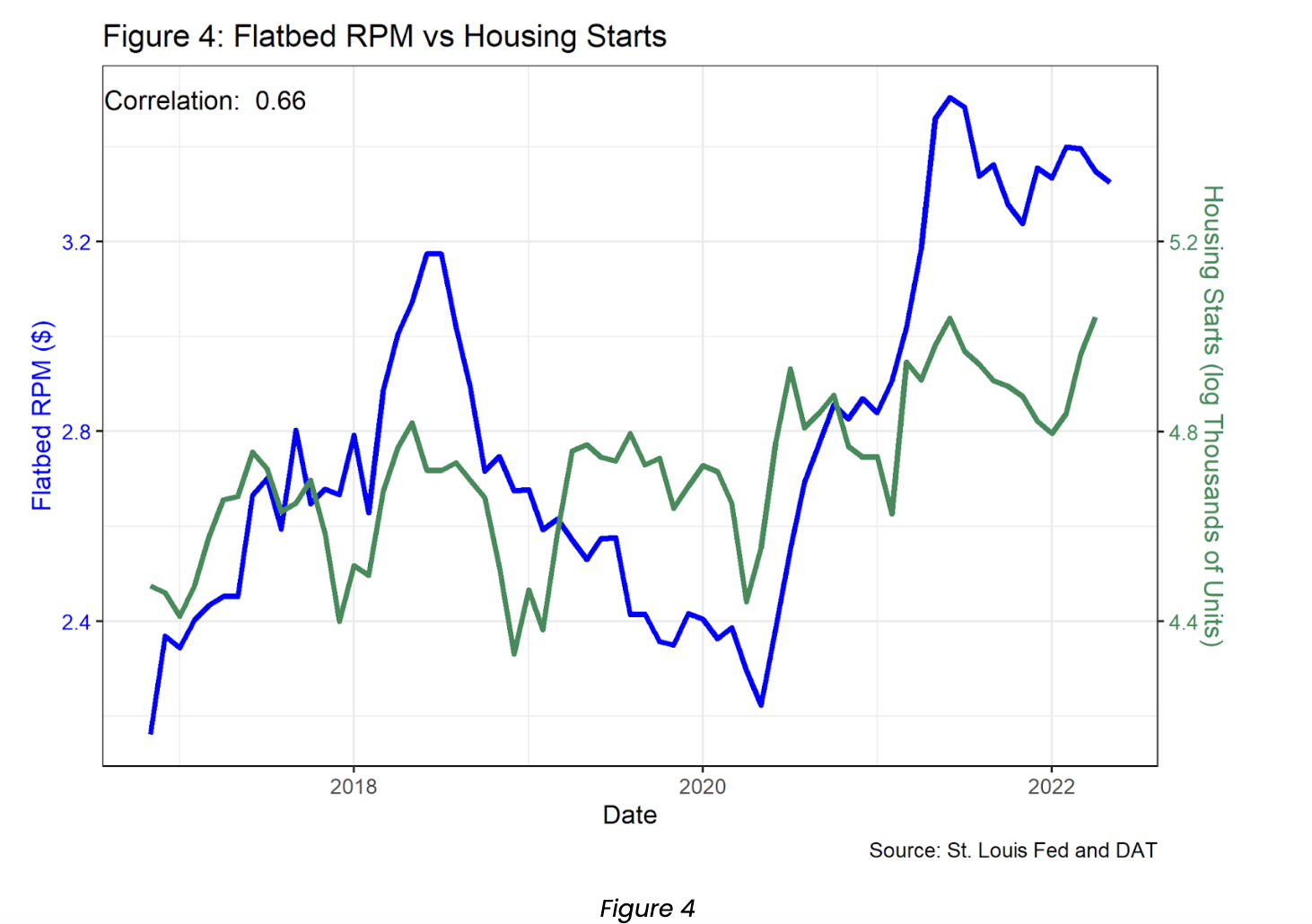

FTL Flatbed vs Housing Starts

- Flatbed rates have reached a yearly low in May of $3.32 RPM (sourced from DAT). Even with the drop, the monthly rate still exceeds last year’s average $3.24 rpm.

- As shown in Figure 4 below, we have observed that new housing starts offer guidance for future FTL flatbed demand.

- Housing starts rose 16.6% in March MoM indicating that the homebuilding activity remains strong despite the surge on mortgage rates. The reasons are that, while inflation increases the borrowing costs, homeownership can work as a hedge against this. Because of this we expect Flatbed demand to increase over the coming months.

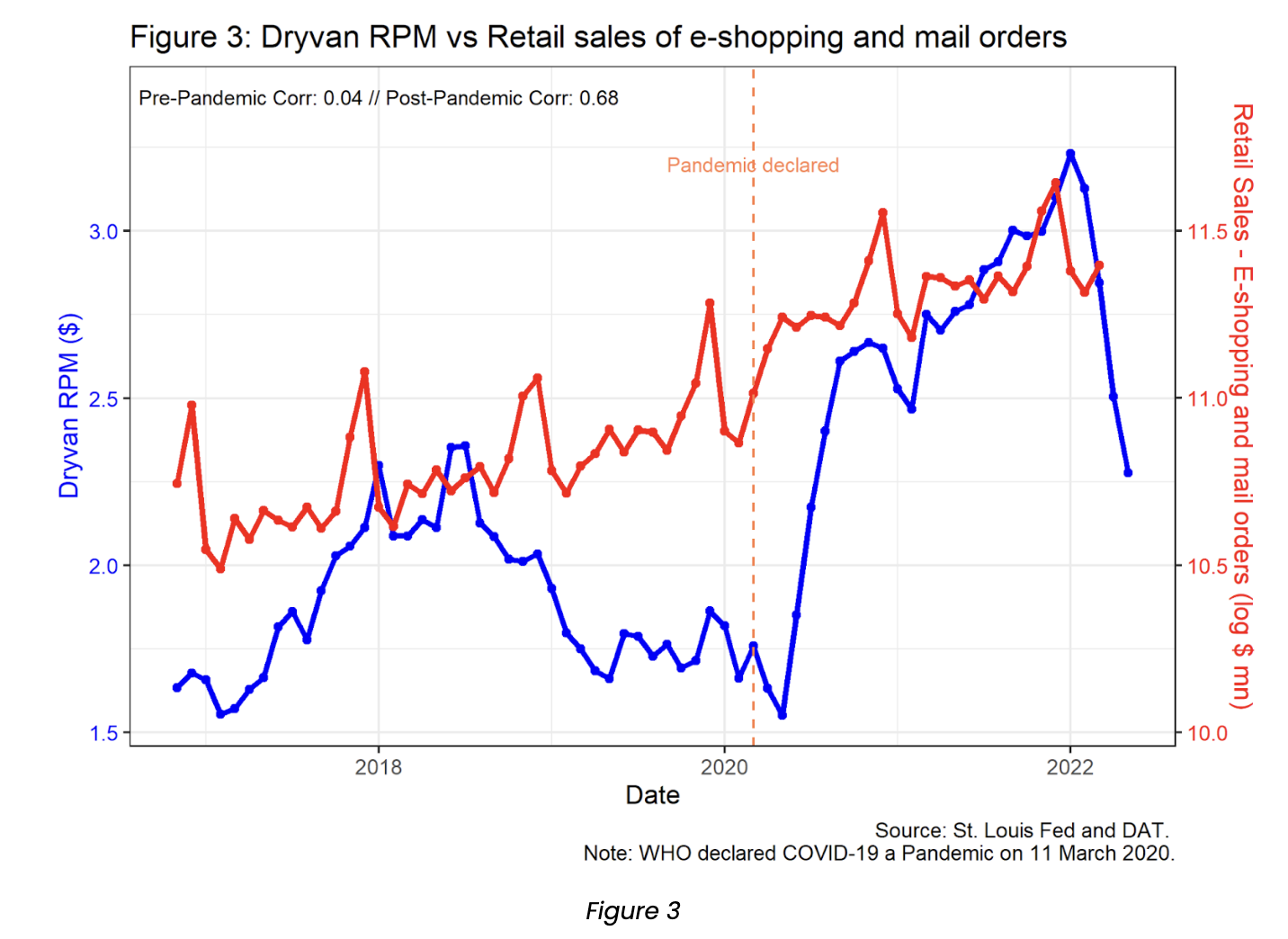

Carrier Costs vs PPI

- The Producer Price Index (“PPI”) measures the percentage change in selling prices that producers receive for their output. So for the freight market, the PPI represents the change in prices the carrier industry receives.

- As seen in Figure 5 below, Despite the historically positive correlation between carrier costs and PPI, since January 2022 there has been a detachment of the two series as carrier costs rpm are down 12% while the PPI is 10% up YTD April numbers.

- The detachment suggests that current market conditions are not allowing carriers to pass on their cost increases (fuel) to shippers.

ABOUT LOADSMART

Transforming the future of freight, Loadsmart leverages technology and logistics data to build efficiency around how freight is priced, booked and shipped. Pairing comprehensive logistics technology with deep-seated freight industry expertise, Loadsmart fuels business growth, simplifies operations and increases efficiency for carriers and shippers alike. For more information, please visit: https://loadsmart.com. Move more with less.

Share this

- Market Trends (76)

- Carrier (64)

- Enterprise Shipper (62)

- Data Insights (49)

- Shipper (49)

- News (44)

- Blog (43)

- SMB Shipper (37)

- Thought Leadership (35)

- Our Partners (29)

- Product Updates (23)

- Mode Optimization (21)

- Warehouse (19)

- Mid-Market Shipper (14)

- Instant Execution (4)

- Asset (3)

- Video (3)

- eBook (3)

- Case Study (2)

- Freight Management (1)

- April 2024 (3)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (6)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)